Call us today:

08 9725 1810

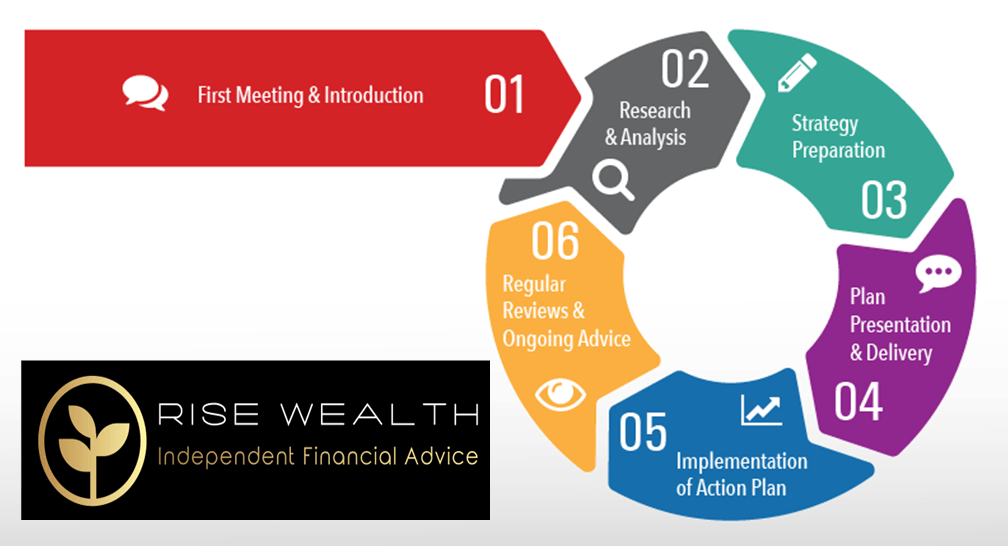

PROCESS

Our Financial Advice and Review Process

Our 6-step financial advice and review process helps us give you the best advice for your needs, means and goals.

These 6-steps exist so we comply or exceed all the requirements set out by the industry and its regulators.

Our staff are actively involved and consult to regulators and committees on behalf of the financial planning industry, not only because we want the best outcome for our clients, but we care about the financial planning industry’s reputation and credibility.

Step 1: First Meeting & Introduction

The first step in our Advice and Review Process is about getting to know each other – what you are looking for and whether we can help you achieve your goals and aspirations and over what timeframe?

What does your life look like today and what do you want it to look like in the future? Whether your financial goals are audacious or modest, long term or short term – now is the time to imagine your goals and where you’d like to be.

Step 2: Research & Analysis Phase

During the second step we drill down into your financial position to see what it takes to achieve your goals, sorting your priorities and if can get to where you want to be in the timeframe you desire.

We also look at other issues you may not have thought of and how this fits into your vision of the future.

Step 3: Strategy Preparation

We prepare a plan that is designed to meet your individual needs and requirements addressing both strategies and products. This action plan will be presented to you in form of a “Statement of Advice” (SOA) in Step 4.

Step 4: Plan Presentation and Delivery

After all of the alternatives and information is analysed, a Statement of Advice (SOA) will be presented to you.

The SOA is a written document prepared especially for you by our team containing specific recommendations to help you meet your financial goals and objectives.

It is vital that you feel comfortable with the strategy, so this is an opportunity to understand what we have recommended and why, and make any adjustments if needed.

Step 5: Implementation of Action Plan

After discussing the financial strategies presented to you in the “Statement of Advice” (SOA) and making any adjustments requested by you, we implement the financial plan and recommendations agreed upon.

Step 6: Regular Reviews and Ongoing Advice

Regular reviews and ongoing advice are essential.

It is no use setting goals and objectives unless your progress is measured to see how you are going.

Things can change – your own situation, markets or legislation – and from time to time the plan may need to be adapted.

We also like celebrating your achievements!

To learn more about our financial advice, call us today on 08 9725 1810

Disclaimer - Advice Warning

Any information or advice on this website is general in nature and does not take into account your personal objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances before you make any decision about whether to acquire a certain product. You should also obtain and read the relevant product disclosure statement.

Rise Wealth Group Pty Ltd I ABN 51 624 210 662 I AFSL 537399

Making a Complaint

We endeavour to provide you with the best advice and service at all times. If you are not satisfied with our services, then we encourage you to contact us. Please call us, send us an email or put your complaint in writing to our office. You can direct your complaint to your financial adviser.

We aim to resolve complaints immediately. Where this is not possible, we will acknowledge the receipt of your complaint within 48 hours. We will then explain our process to resolve your complaint and tell you who will handle your complaint.

If you are not satisfied with our response after 30 days, you can lodge your complaint with the Australian Financial Complaints Authority. You can contact AFCA on 1800 931 678 or via their website www.afca.org.au. AFCA provides fair and independent financial services complaint resolution which is free to consumers.